Updates to the CEWS – Per our previous posting on April 15, the CEWS as put in place for an initial 12-week period ending June, 6, 2020. This was extended for an additional 12-weeks, ending August 29, 2020.

Draft legislation has been released to extend the program until at least November 21, 2020. This extension includes some rule changes that are important to take note of.

Effective July 5, 2020 (period 5 and subsequent periods), the CEWS will now be made up of two parts:

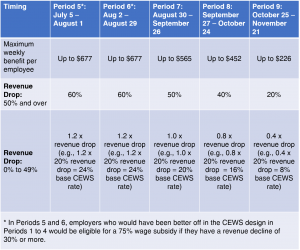

- Base: available to all eligible employers that are experiencing a decline in revenues, with the subsidy amount varying depending on the scale of revenue decline (see picture #1). The base will be the specified rate applied to the remuneration paid to the employee for the period, on remuneration up to $1,129. The base rate will vary depending on the level of revenue decline, and is extended to employers who have had a drop of less than 30% so all employers with a revenue decline will qualify. This decrease will either be based on the revenue decline for either the current or previous month (whichever is greater) compared to the same month in 2019 (or the average of January and February 2020 revenue if that method is chosen)

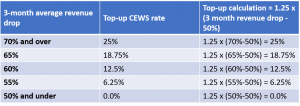

- Top-up: up to an additional 25 per cent for those employers that have been most adversely affected by COVID-19 (Picture #2). The top-up will be available to employers who have had a three-month average revenue decline of 50% or more compared to the same three months in 2019 (or the average of January and February 2020 if that method is chosen)

Please see the CRA website (https://www.canada.ca/en/department-finance/news/2020/07/adapting-the-canada-emergency-wage-subsidy-to-protect-jobs-and-promote-growth.html) for more information regarding the changes to the CEWS as well as other COVID-19 related information and programs.

If you have any questions about this or any of the other COVID-19 related programs, including how to apply, please reach out to a member of the GSE team and they would be glad to assist you.

(Picture #1 – Base Calculation)

(Picture #2 – Top-up Calculation)

________________________________________________________________________________________

On April 11, 2020 updated information regarding the CEWS was made available.

Some key items are summarized below. Please see the CRA website for updates and additional details on CEWS including calculating subsidy amount: https://www.canada.ca/en/department-finance/news/2020/04/additional-details-on-the-canada-emergency-wage-subsidy0.html

- Eligible employers include individuals, taxable corporations, partnerships, non-profit organizations and registered charities

- Subsidy is available to eligible employers who have seen a drop of at least 15% of revenues in March and 30% in subsequent months

- Charities and non-profit organization are allowed to choose to either include or not to include government funding as part of their calculation, but this must be applied consistently

- Employers will have a choice of using an average of revenues reduction for January and February 2020 OR for the same period in the prior year

- Once an employer is approved, it will automatically qualify for the next period

- There are three qualifying periods:

- Mach 15, 2020 to April 11, 2020 (based on March revenue decline)

- April 12, 2020 to May 9, 2020 (based on April revenue decline)

- May 10, 2020 to June 6, 2020 (based on May revenue decline)

- Eligible employees include individuals who are employed in Canada, and will be available to employees other than those who have been without pay for 14 or more consecutive days in the eligibility period.

- Employers can apply through their CRA My Business Account

________________________________________________________________________________________

There are new proposed changes to the CEWS bill coming from the Government of Canada including:

- A new option to use January and February as reference points

- A 15% revenue reduction threshold instead of the 30% originally proposed for March

- Charities and NPO’s may include or exclude government funding to measure revenue drop

- The Government is actively asking companies to rehire their workers using the subsidy, even if the employees don’t work or work less than before.

________________________________________________________________________________________

Prime Minister Justin Trudeau and the Canadian Government have announced a new lifeline to the economy to help Canadians and businesses get through the challenges caused by the pandemic. The Canada Emergency Wage Subsidy aims to prevent further job losses by allowing businesses to retain the employees they have on payroll who may not be working, while also encouraging businesses to re-hire workers that have already been laid off as a result of the crisis. The program promises to provide a 75% wage subsidy to employers for up to 12 weeks, retroactive to March 15th.

To learn if you are an Eligible Employer, how to calculate the amount of subsidy you will receive, and for information regarding how to apply for the subsidy you can read the full announcement at www.cananda.ca.