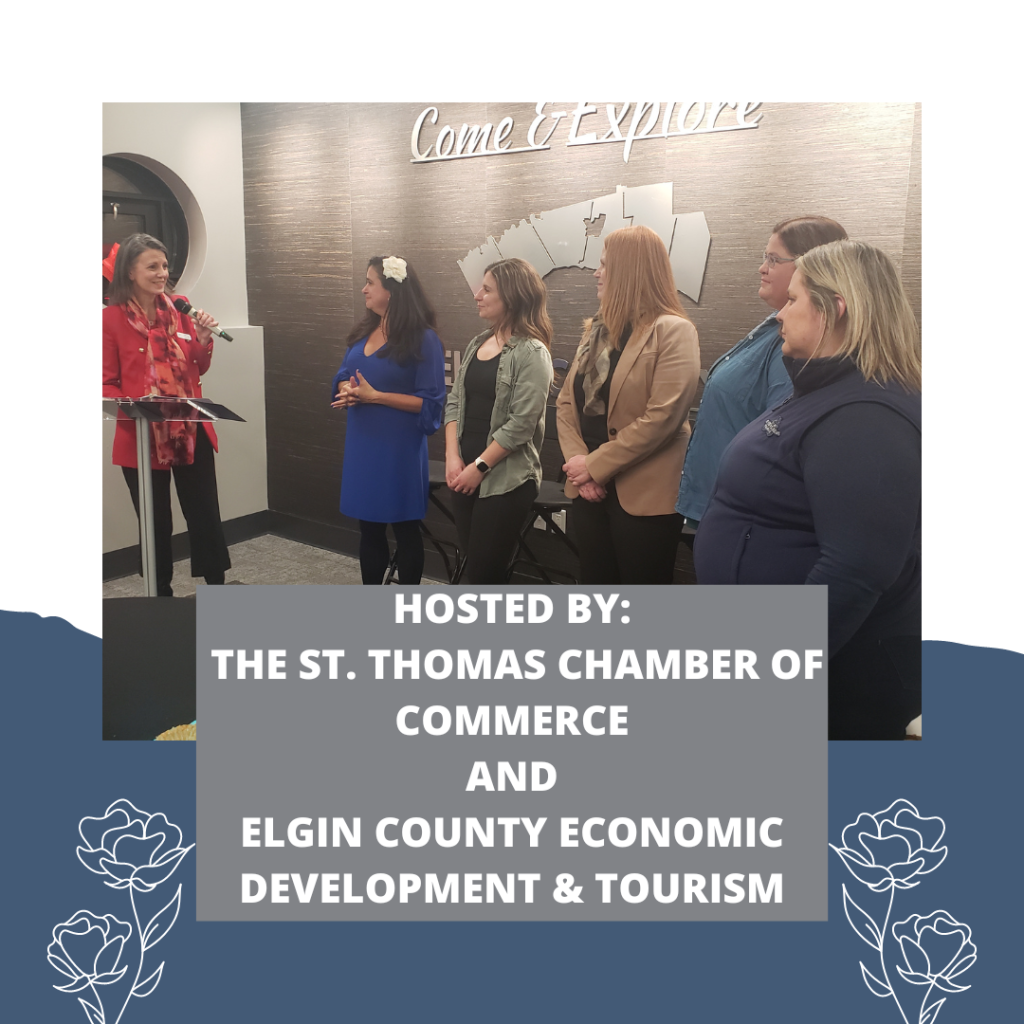

To celebrate International Women’s Day, Jennifer Buchanan (Partner at GSE) and Breanna Reid (Manager at GSE) attended the Women in Agriculture Celebration event held at the Elgin County Building in St. Thomas on March 8, 2023. The evening was full of empowerment and connection, and it was an inspiring way to recognize and celebrate female agricultural business owners in our local community! Thank you to all of the great speakers and to St. Thomas & District Chamber of Commerce and Elgin County Economic Development and Tourism for hosting this wonderful event!

ntTourisim for hosting this wonderful event!

ntTourisim for hosting this wonderful event!

\

\

]

]