Additional Office Hours – Tax Season 2023

Highlights In This Issue:

Highlights In This Issue:

Highlights:

Year-End Tax Planning for 2022

2022 Remuneration

Tax Tips & Traps 2022 Year End Tax Planning

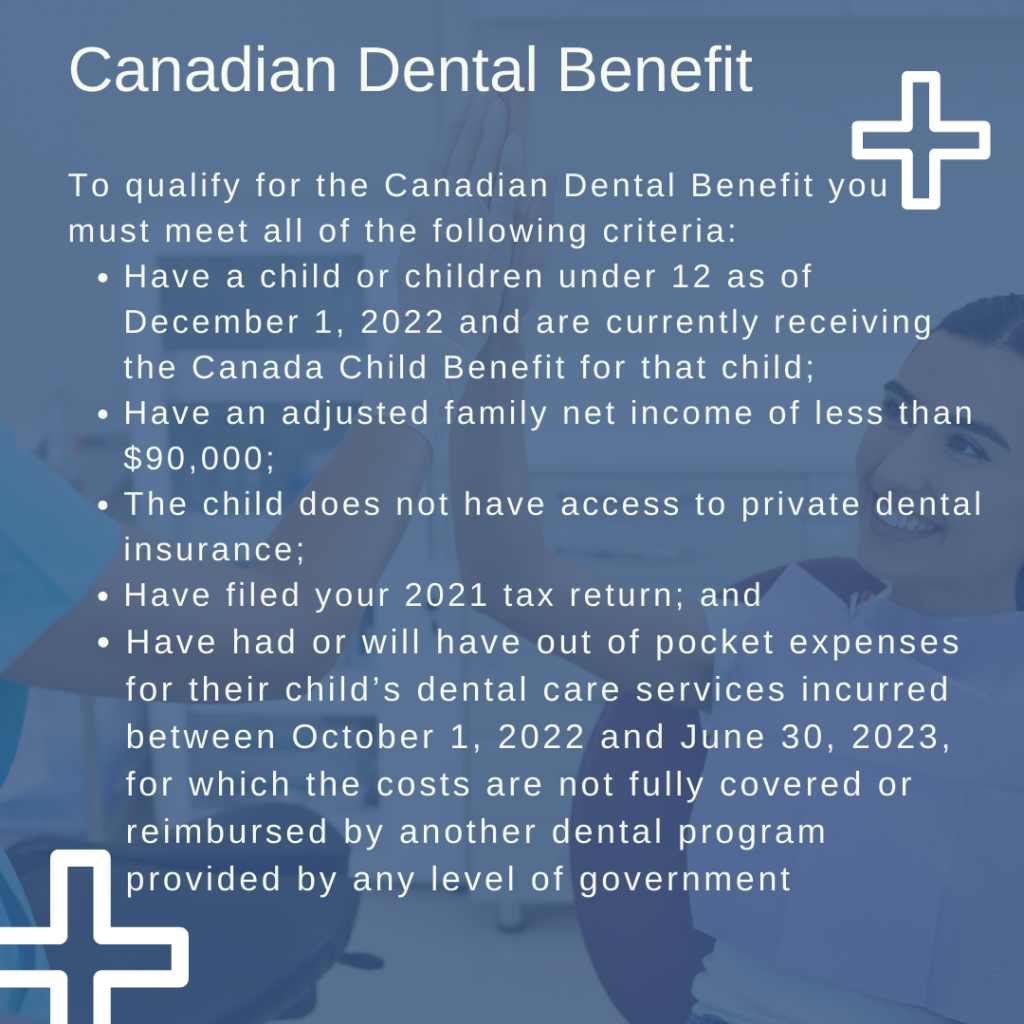

Do you have a child under the age of 12? If so, you may qualify for the Canadian Dental Benefit!

This benefit will give eligible families up-front, direct payments of up to $650 a year per eligible child under 12 for two years to help cover the costs of dental care services.

Payments will range between $260 and $650, depending on the adjusted net income. This payment will be tax free, and available for each eligible child, for two periods. The first period is for children under 12 as at December 1, 2022 who had dental care between October 1, 2022 and June 30, 2023.

Full criteria include:

More information on the Canada Dental Benefit can be found here: Canada Dental Benefit – Canada.ca

Highlights In This Issue:

Highlights In This Issue:

Highlights:

Tax Tidbits

Buying and Selling a Home: Budget 2022

Principal Residence Exemption

CERB/CRB: Eligibility Verification

Estimated Sales by CRA: Audit File Selection and Assessment

Auditing Old Tax Returns: CRA Abilities and Limitations

Money Received from Abroad: CRA Reviews

Digital Adoption Program: Grants, Loans and Professional Assistance

Last night, Managers and Partners from GSE attended the Uplift – Your Voice, Your Business, and Your Community event, presented by Elgin-St. Thomas Small Business Enterprise Centre. This amazing event featured guest speaker Jam Gamble, and focused on gaining confidence and finding your voice to help elevate your life, business, and community. This was a great opportunity to gather with business and community leaders, and spend time together as a team!