As cloud-based computing has become more popular, we have had many clients switch over their accounting software to QuickBooks Online. In order to streamline the process of giving Graham Scott Enns access to your QuickBooks Online account, we have created a step-by-step guide on how to give us access, which will prevent you from having to re-send access in the future.

You can check out this, and a bunch of other useful documents for our clients in our Document Library on our website. Visit www.grahamscottenns.com/document-library/ to view this and all other documents!

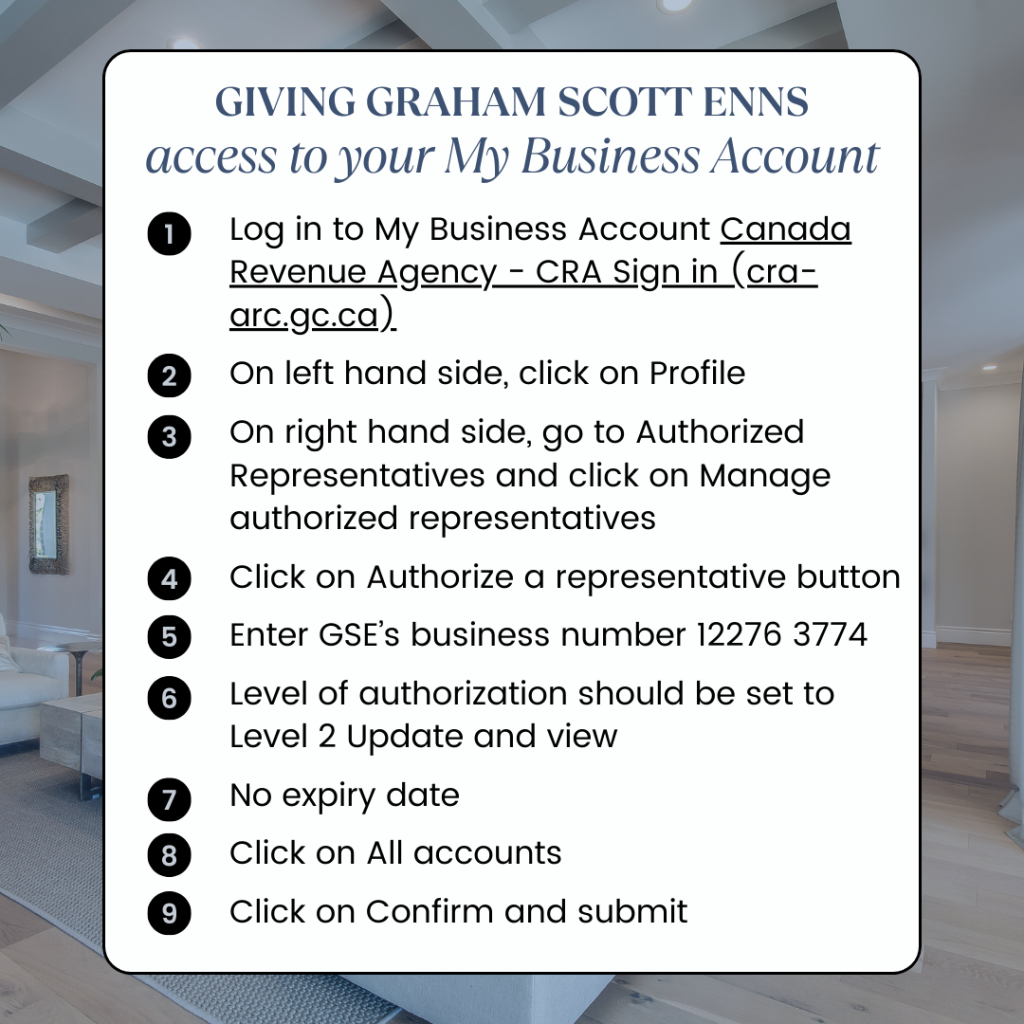

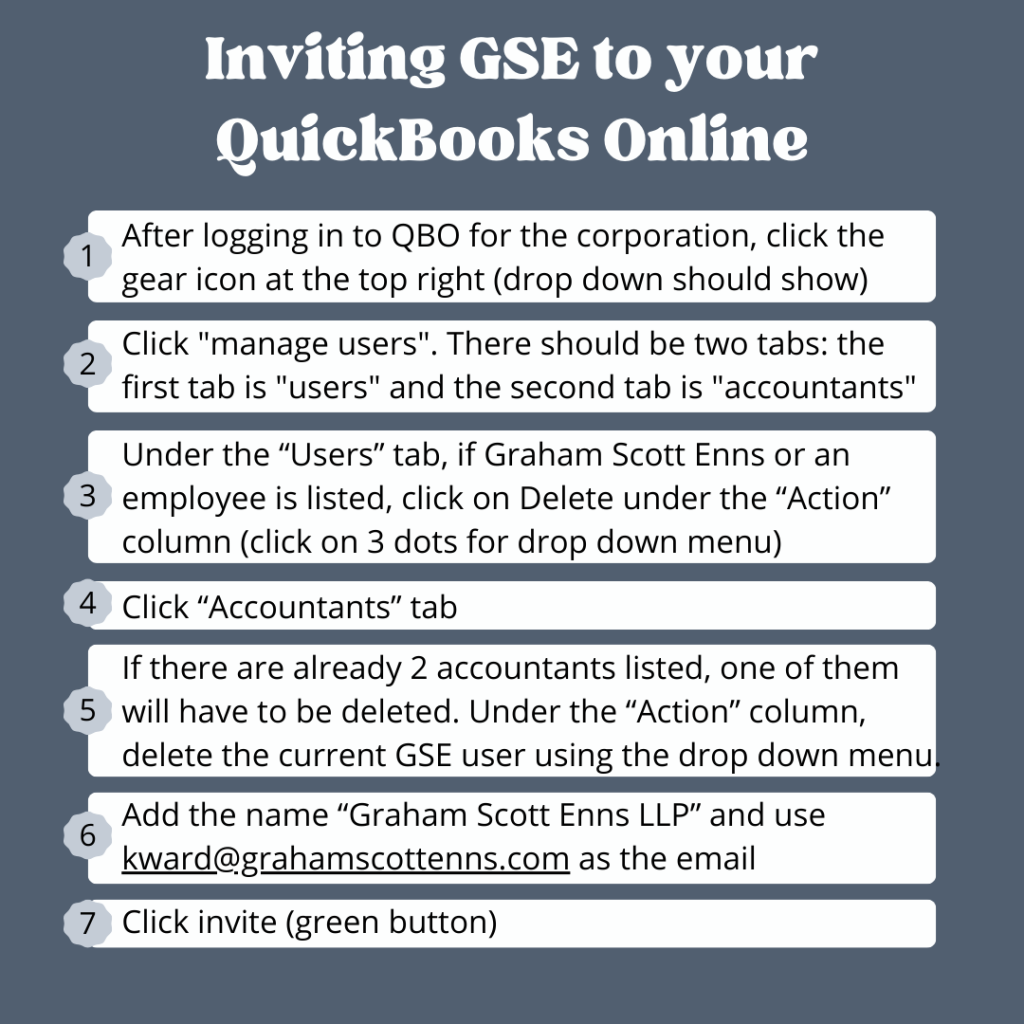

Inviting GSE to your QuickBooks Online

1. After logging in to QBO for the corporation, click the gear icon at the top right (drop down should show)

2. Click “manage users”. There should be two tabs: the first tab is “users” and the second tab is “accountants”

3. Under the “Users” tab, if Graham Scott Enns or an employee is listed, click on Delete under the “Action” column (click on 3 dots for drop down menu)

4. Click “Accountants” tab

5. If there are already 2 accountants listed, one of them will have to be deleted. Under the “Action” column, delete the current GSE user using the drop down menu.

6. Add the name “Graham Scott Enns LLP” and use kward@grahamscottenns.com as the email

7. Click invite (green button)