On Friday September 13, 2024, GSE held its fourth annual baseball game and BBQ potluck. This year, we played a game of soccer baseball, adding a fun twist to our traditional baseball event.

This family friendly event was more than just fun and games, it was a wonderful opportunity for colleagues and their families to bond and share some laughs together. A big thank you to everyone who attended the event and helped make it a memorable occasion.

Also, a special thank you to Kelly Ward, Manager, for hosting the BBQ and to the Social Committee for organizing a wonderful afternoon.

Blog | Community

33rd Annual Westover Treatment Centre Charity Golf Tournament

On September 9, 2024, Graham Scott Enns LLP Partner, Mike MacKinnon, and Manager, Breanna Reid, attended the 33rd Annual Westover Treatment Centre Charity Golf Tournament. This was a wonderful day of golf and a great opportunity to connect with members of our community. We are proud to support great organizations such as Westover Treatment Centre.

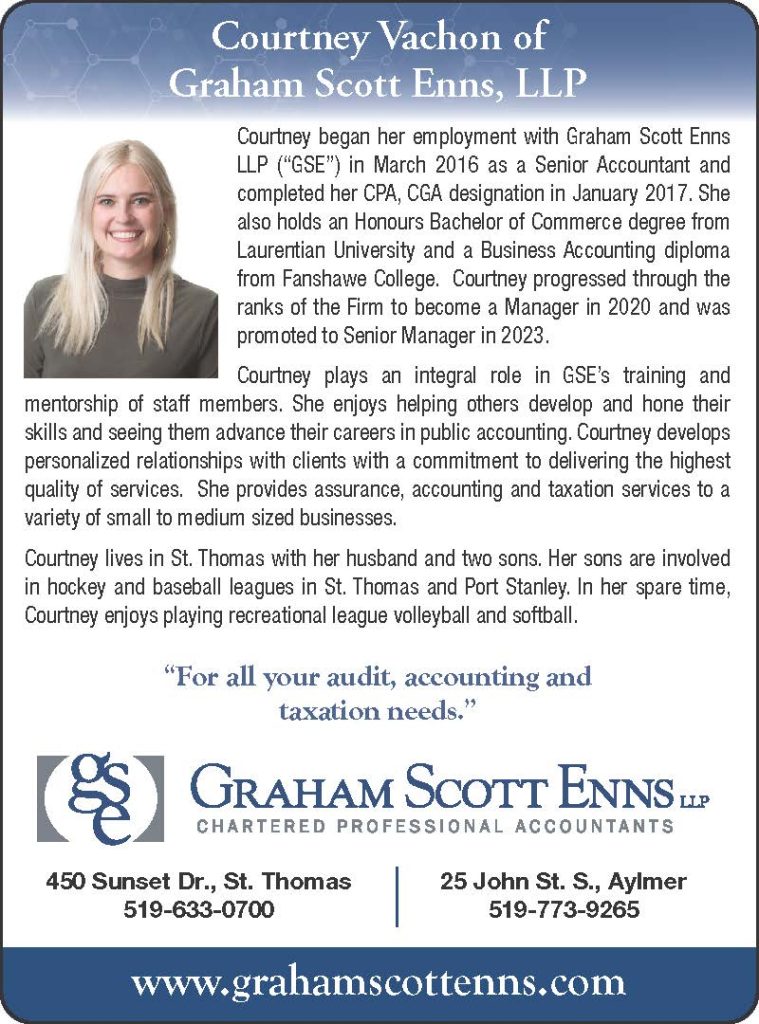

Check out Courtney Vachon in This Month Elgin (September 2024)

Graham Scott Enns LLP is very proud to share with you that Courtney Vachon, Senior Manager at GSE, was featured in the September 2024 issue of This Month Elgin magazine as part of their Women in Business feature. Courtney is an integral part of our team here at GSE and provides a variety of services including assurance, accounting and tax, in addition to training and mentoring our staff,

Indwell Summer BBQ

One of our values at Graham Scott Enns LLP is Community. Each year, staff are provided paid volunteer hours to support local organizations. This year, GSE employees had the opportunity to work with Indwell. Indwell is a charity organization that creates affordable housing in the communities they serve. Volunteers from GSE assisted with a summer BBQ. This provided the opportunity to connect with the tenants while preparing and serving a meal. Volunteer opportunities such as this provide GSE staff with a sense of connection to our community, and an opportunity to develop meaningful relationships.

Thank you to Indwell for allowing us to give back to our community, and thank you for the work that you do.

Pride 2024

Graham Scott Enns LLP wishes everyone a Happy Pride Month!

GSE is a firm committed to providing an inclusive and supportive environment for all staff and all members of our community.

By participating in Diversity, Equity, Inclusion and Belonging training, GSE strives to live up to our core Firm values of Community-Orientation, Progressiveness, and Integrity.

All are welcome at GSE!

IMPORTANT ANNOUNCEMENT: 2023 Bare Trust Filings

Important Announcement Regarding Bare Trusts

CRA has just announced that bare trusts are exempt from trust reporting requirements for 2023. CRA stated:

“To support ongoing efforts to ensure the effectiveness and integrity of Canada’s tax system, the Government of Canada introduced new reporting requirements for trusts.

In recognition that the new reporting requirements for bare trusts have had an unintended impact on Canadians, the Canada Revenue Agency (CRA) will not require bare trusts to file a T3 Income Tax and Information Return (T3 return), including Schedule 15 (Beneficial Ownership Information of a Trust), for the 2023 tax year, unless the CRA makes a direct request for these filings.

Over the coming months, the CRA will work with the Department of Finance to further clarify its guidance on this filing requirement. The CRA will communicate with Canadians as further information becomes available.”

Please visit the CRA website to learn more: New – Bare trusts are exempt from trust reporting requirements for 2023 – Canada.ca

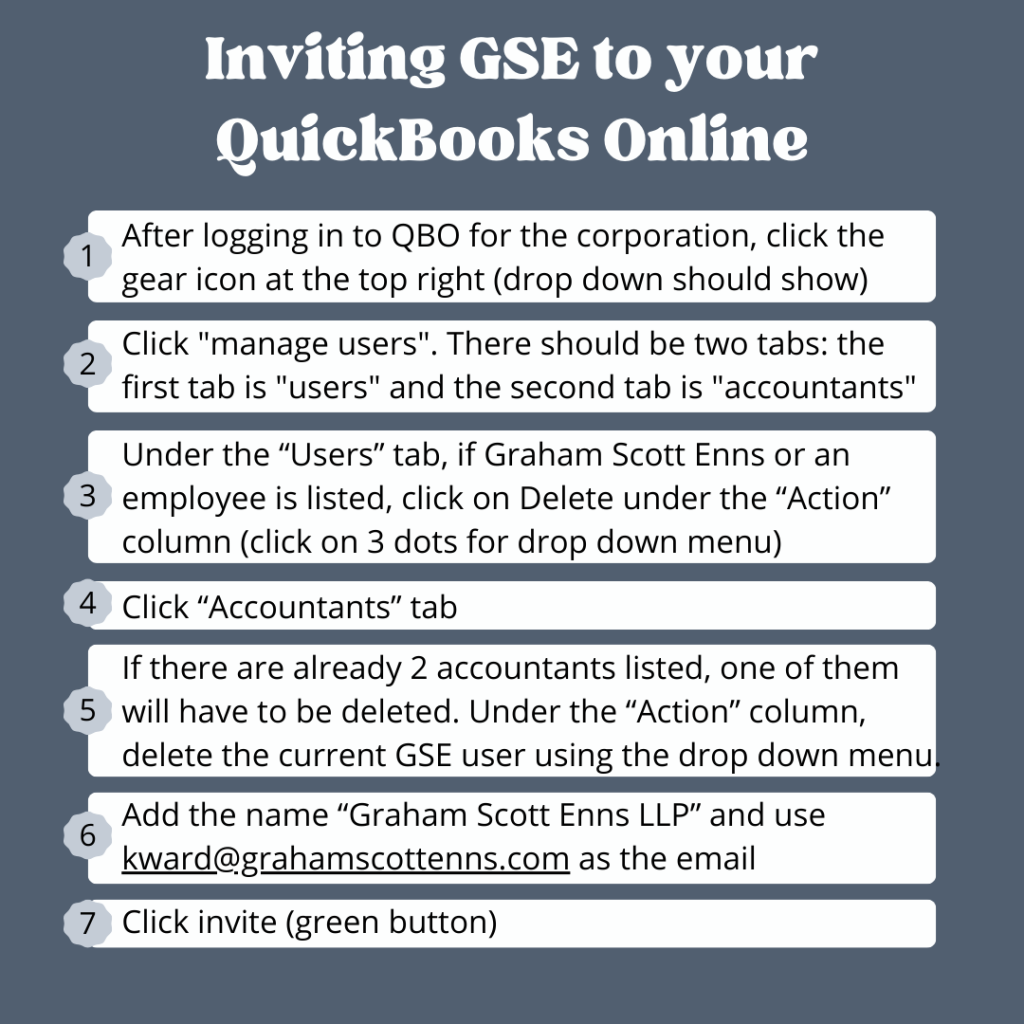

Inviting us to your QuickBooks Online

As cloud-based computing has become more popular, we have had many clients switch over their accounting software to QuickBooks Online. In order to streamline the process of giving Graham Scott Enns access to your QuickBooks Online account, we have created a step-by-step guide on how to give us access, which will prevent you from having to re-send access in the future.

You can check out this, and a bunch of other useful documents for our clients in our Document Library on our website. Visit www.grahamscottenns.com/document-library/ to view this and all other documents!

Inviting GSE to your QuickBooks Online

1. After logging in to QBO for the corporation, click the gear icon at the top right (drop down should show)

2. Click “manage users”. There should be two tabs: the first tab is “users” and the second tab is “accountants”

3. Under the “Users” tab, if Graham Scott Enns or an employee is listed, click on Delete under the “Action” column (click on 3 dots for drop down menu)

4. Click “Accountants” tab

5. If there are already 2 accountants listed, one of them will have to be deleted. Under the “Action” column, delete the current GSE user using the drop down menu.

6. Add the name “Graham Scott Enns LLP” and use kward@grahamscottenns.com as the email

7. Click invite (green button)

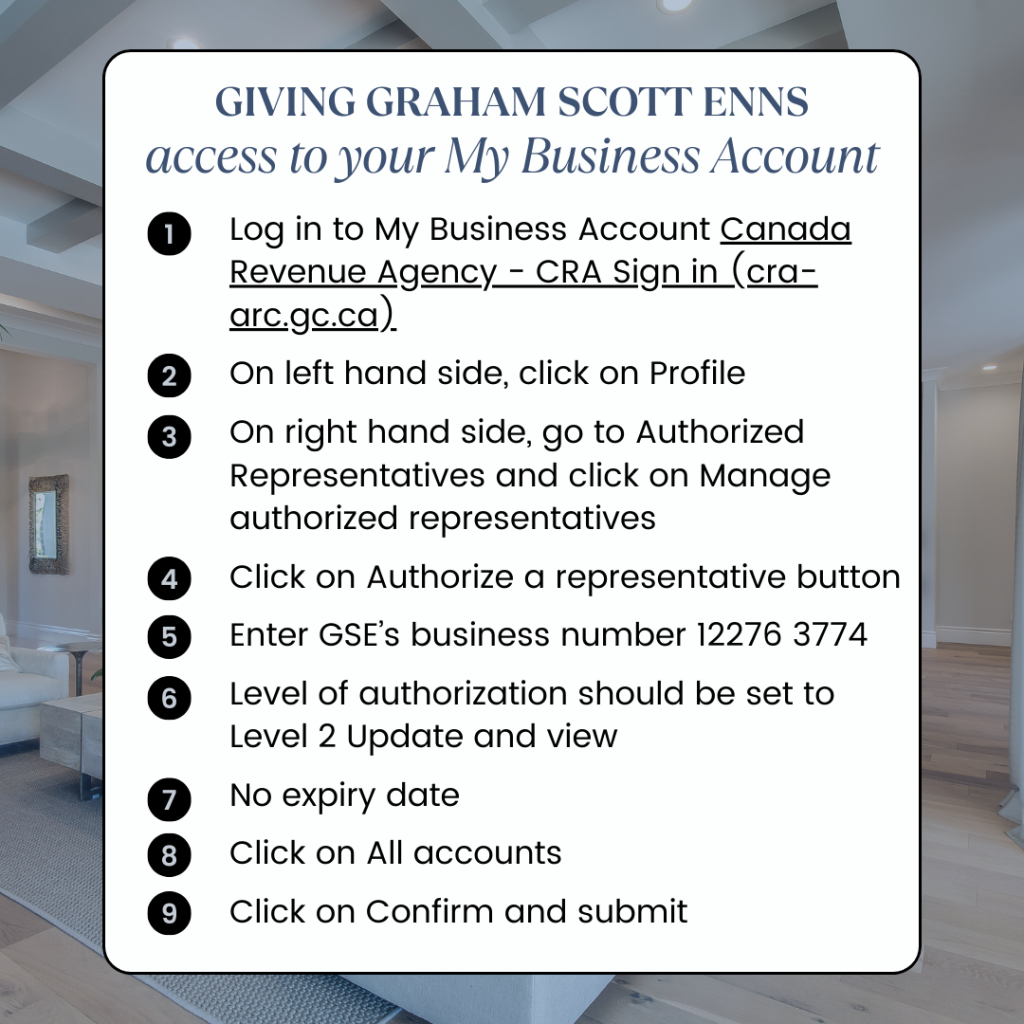

Giving us access to your My Business Account

In order to talk to the CRA on behalf of our clients, we need to get authorization from them to in order to become representatives. If you have a business, you will need to give us access to your My Business Account with the CRA.

In order to do this, we have complied a list of the steps that you will need to take in order for this process to be completed. You can check out this, and a bunch of other useful documents for our clients in our Document Library on our website. Visit www.grahamscottenns.com/document-library/ to view this and all other documents!

Steps:

1. Log in to My Business Account Canada Revenue Agency – CRA Sign in (cra-arc.gc.ca)

2. On left hand side, click on Profile

3. On right hand side, go to Authorized Representatives and click on Manage authorized representatives

4. Click on Authorize a representative button

5. Enter GSE’s business number 12276 3774

6. Level of authorization should be set to Level 2 Update and view

7. No expiry date

8. Click on All accounts

9. Click on Confirm and submit

International Women’s Day 2024

GSE Attends 32nd Annual Night of Heroes

On February 22, 2024, a number of GSE firm members attended the 2024 Night of Heroes Fashion Show and Silent Auction presented by Community Living London. It was an amazing night filled with lots of joy and inspiration. Every year, GSE looks forward to supporting these wonderful community members and their local heroes.